Trust Score: 89/100

Based on regulatory status, company history, and financial transparency

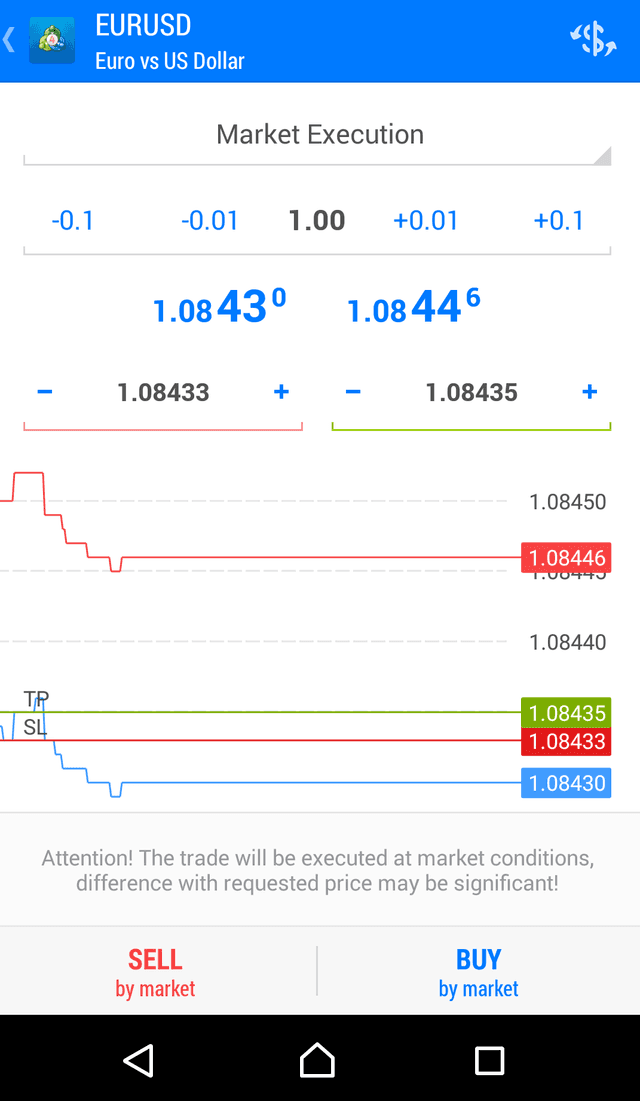

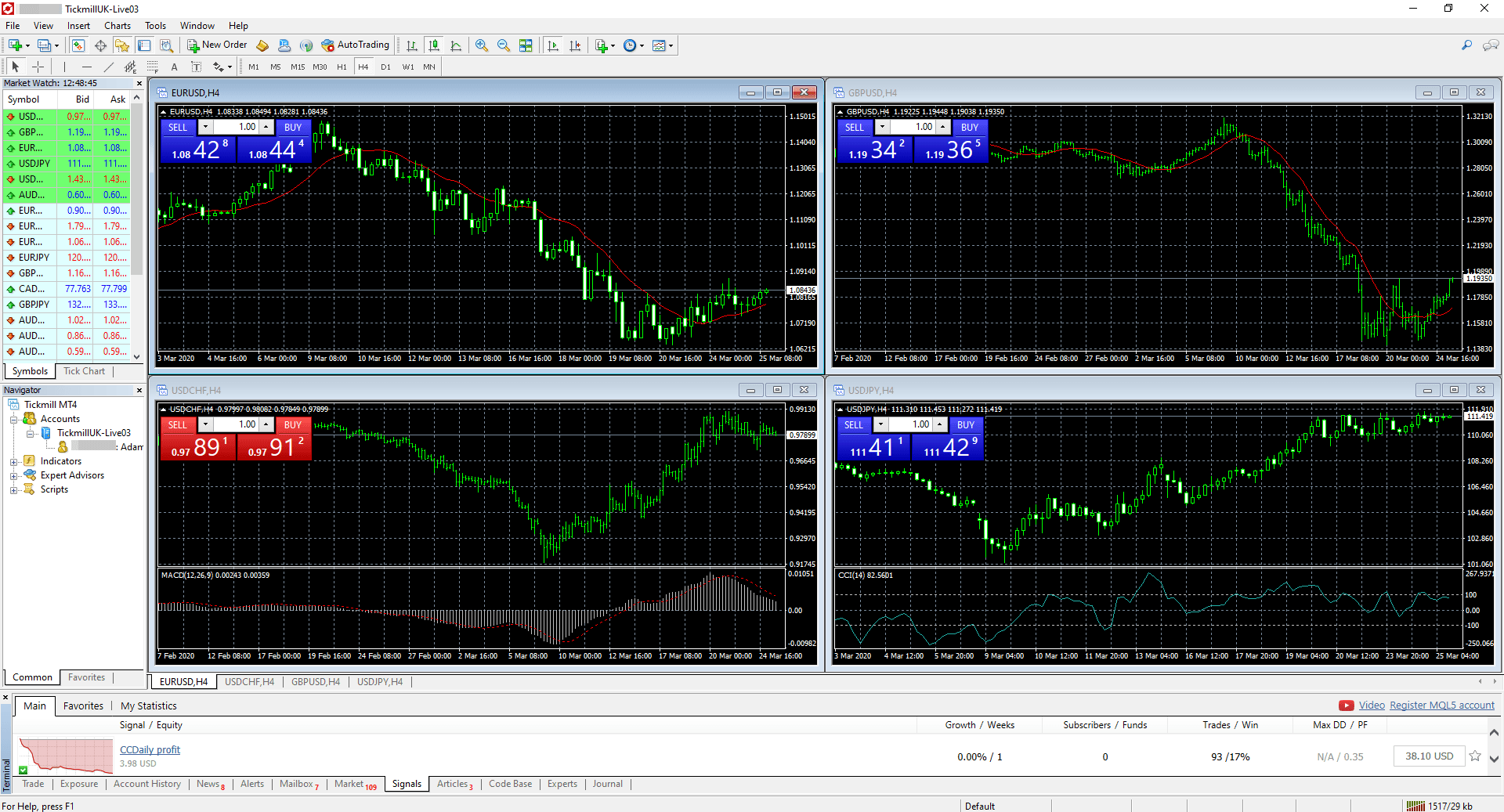

- Lowest Spreads 2026

- Great for Scalping/EAs

- FCA/CySEC Regulated

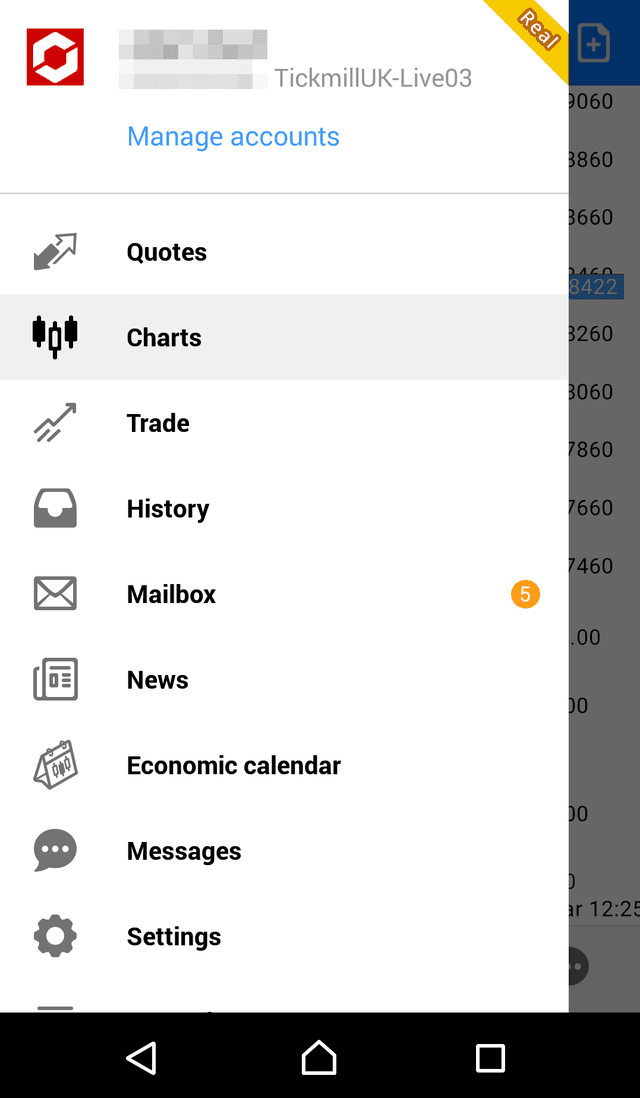

- No Dealing Desk

- High Leverage (Intl)

Founded

2014

Headquarters

London, UK

Clients

350,000+

Why choose Tickmill

Tickmill remains the choice for smart money in 2026, favored by algorithmic traders for its rock-bottom costs and 'no-dealing desk' commitment.

Pros

- Very low trading costs

- Fast execution speeds

- Allowed for all strategies

- Strong regulation

- No withdrawal fees

Cons

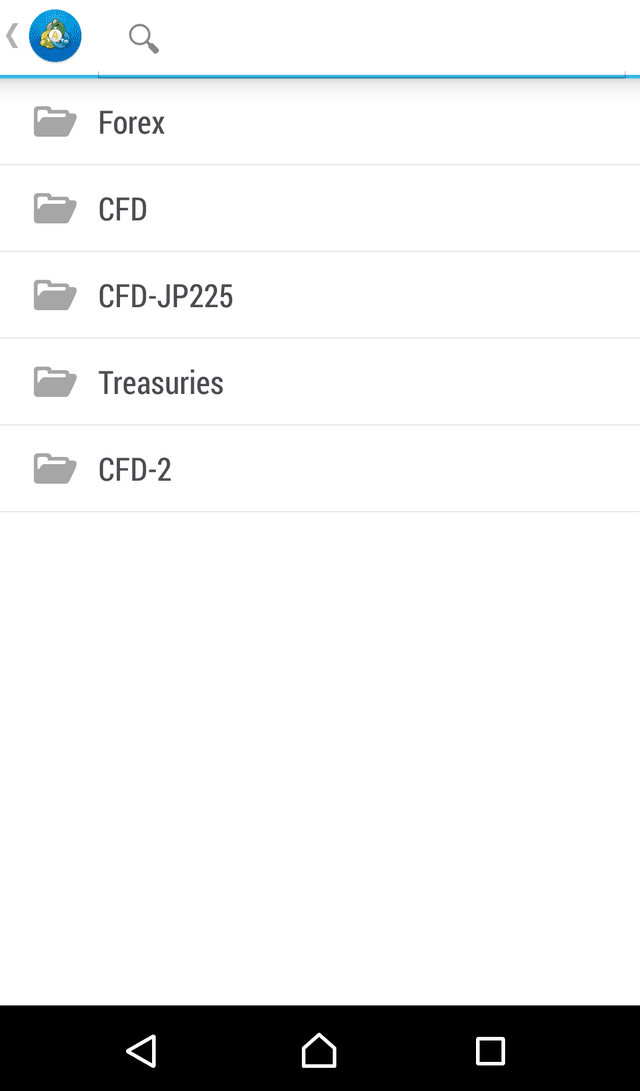

- Limited non-forex product range

- No crypto for UK clients