Trust Score: 4.9/100

Based on regulatory status, company history, and financial transparency

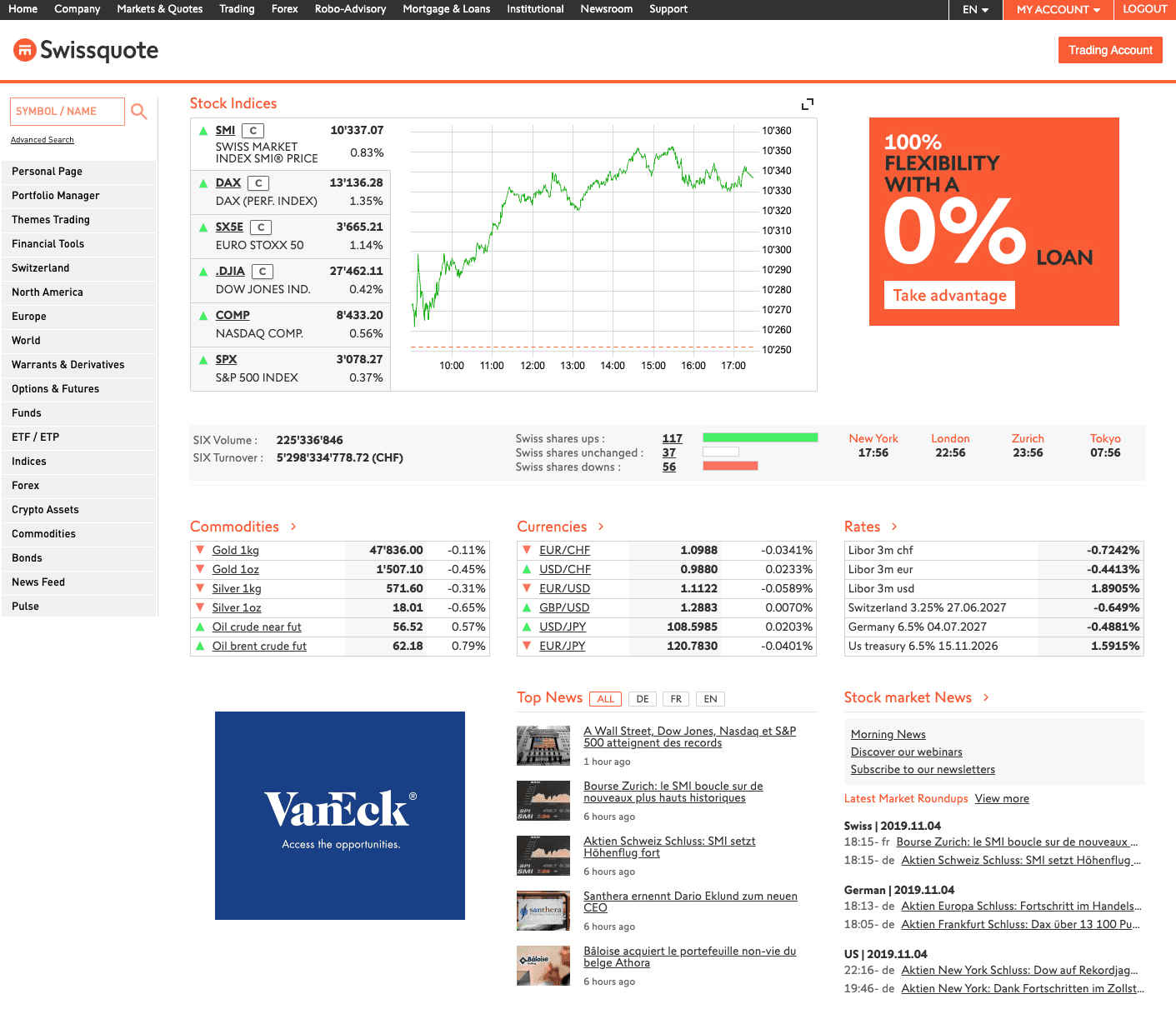

- Swiss Bank License

- Listed on SIX (SQN)

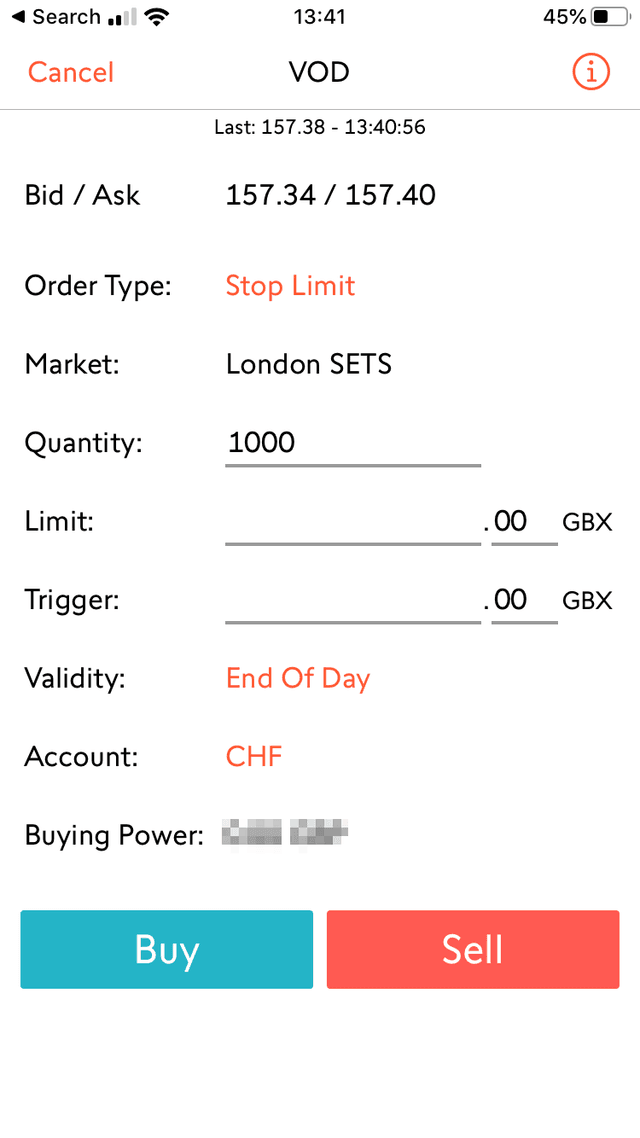

- Integrated Banking & Trading

- Yield on Cash

Founded

1996

Headquarters

Gland, Switzerland

Stock Symbol

Why choose Swissquote

Swissquote remains the undisputed leader in Swiss online banking and trading for 2026. It offers a fortress-like secure environment for Forex, Stocks, and Crypto, backed by a Swiss banking license.

Pros

- Maximum safety (Swiss Bank)

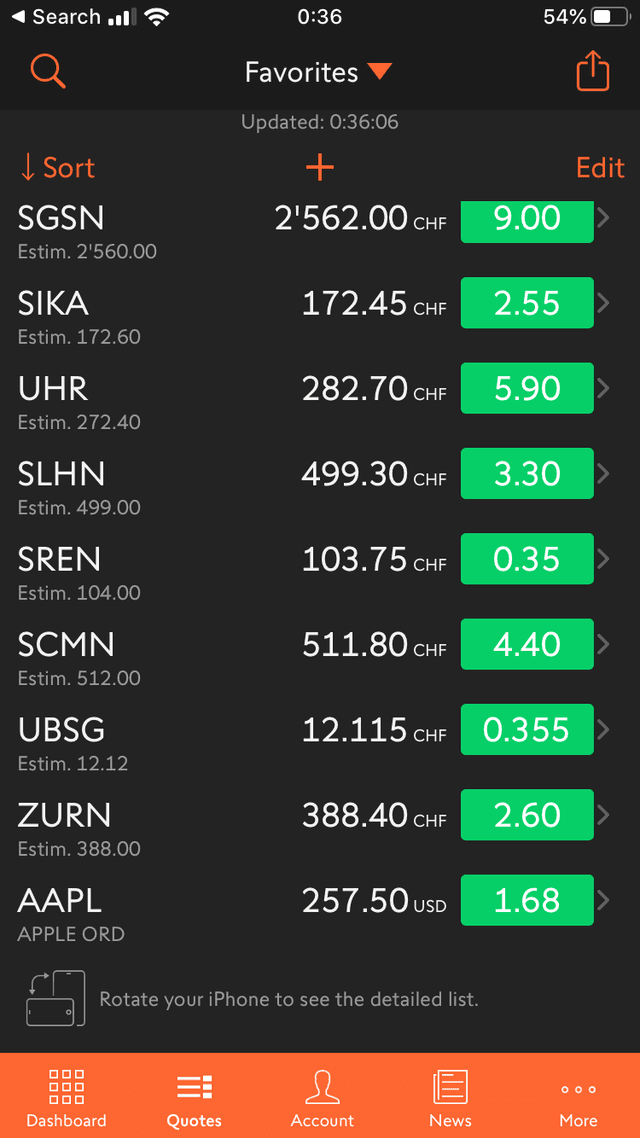

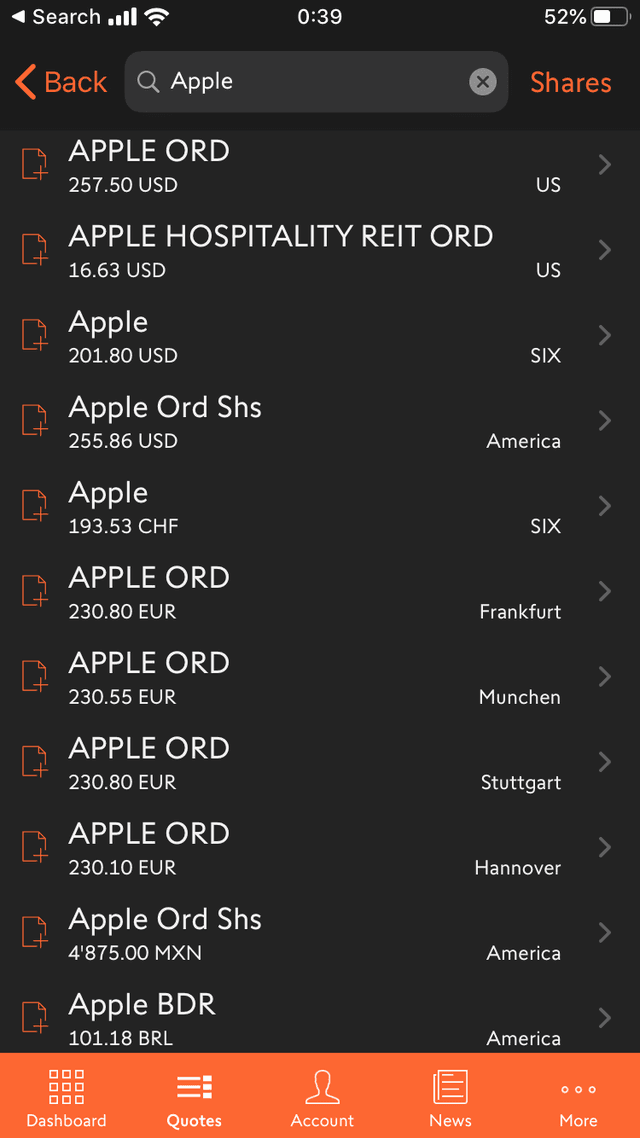

- Huge product range (3M+)

- Banking integrated

Cons

- High fees

- Higher minimum deposit

Swissquote

Save Wishlist's

Popular choice

Min Deposit: | $50 |

Inactivity Fee: | No |

Regulated: | Yes |