Trust Score: 92/100

Based on regulatory status, company history, and financial transparency

- FTSE 250 publicly traded company (LON: PLUS)

- Regulated by 10+ global authorities (FCA, ASIC, CySEC, MAS)

- 27 million+ registered traders worldwide

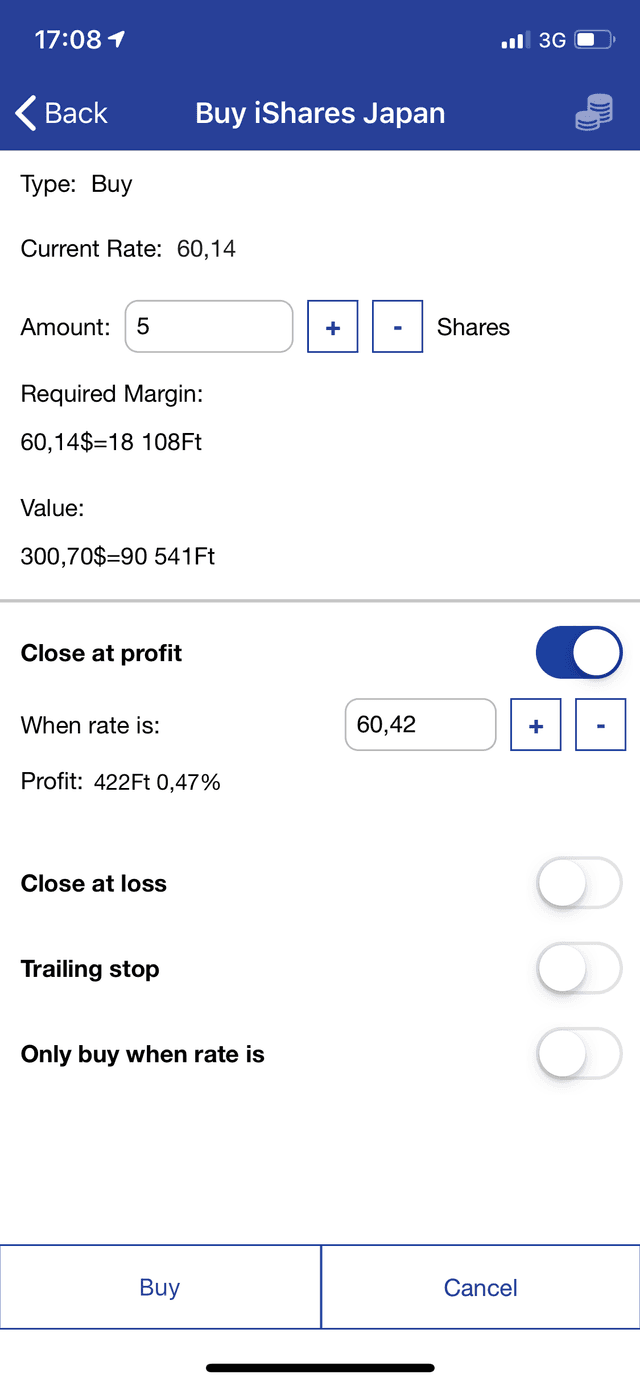

- Commission-free trading (spread-based model)

- Free guaranteed stop orders

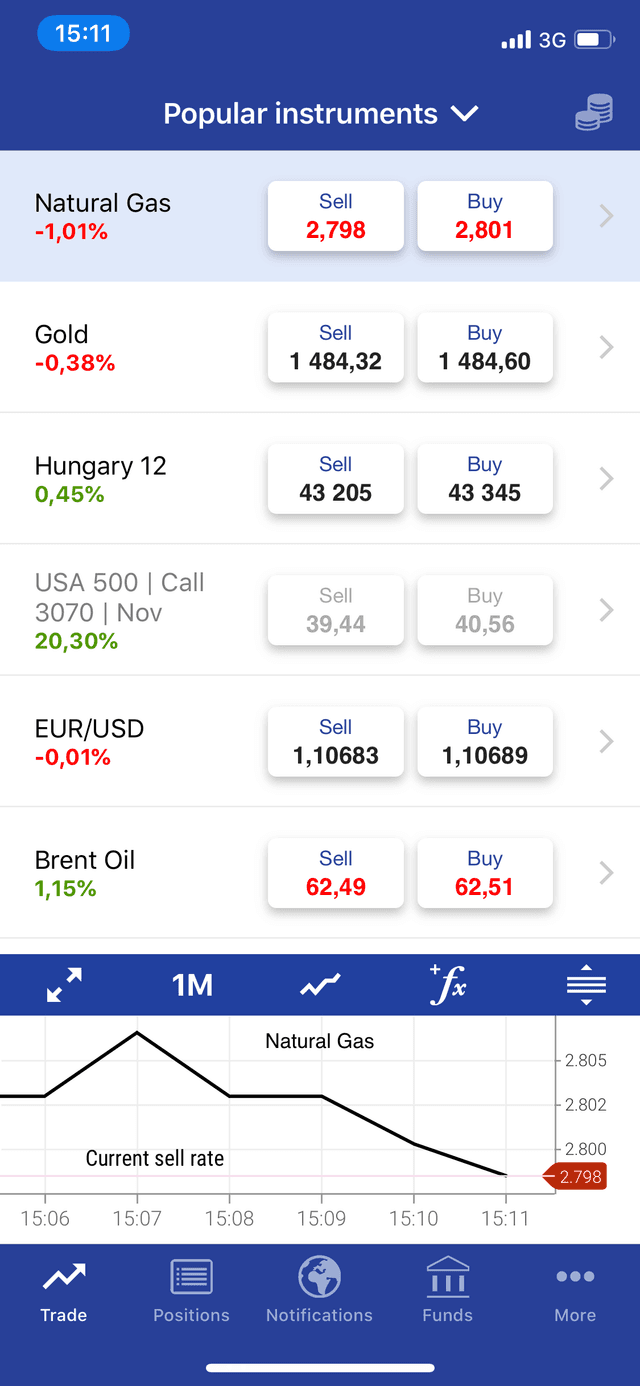

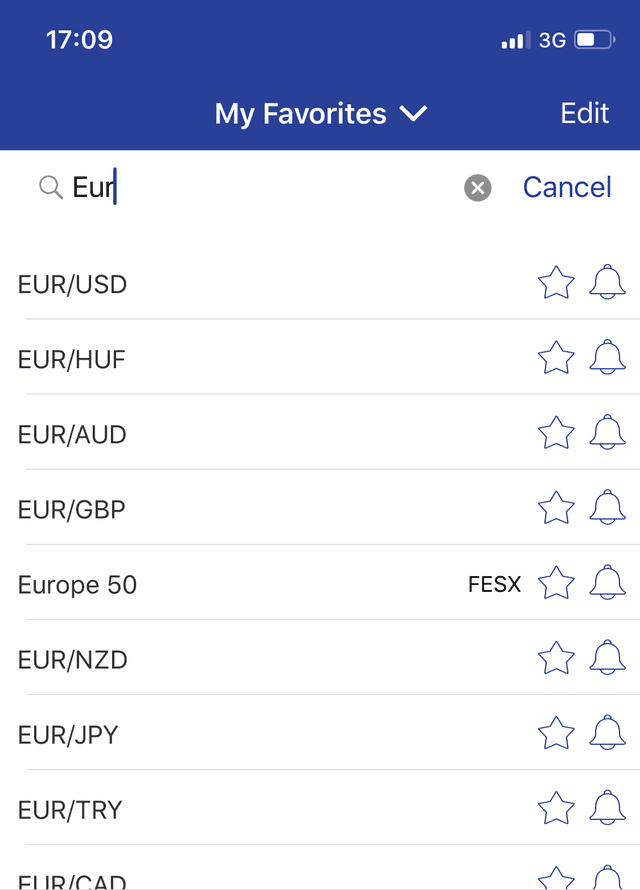

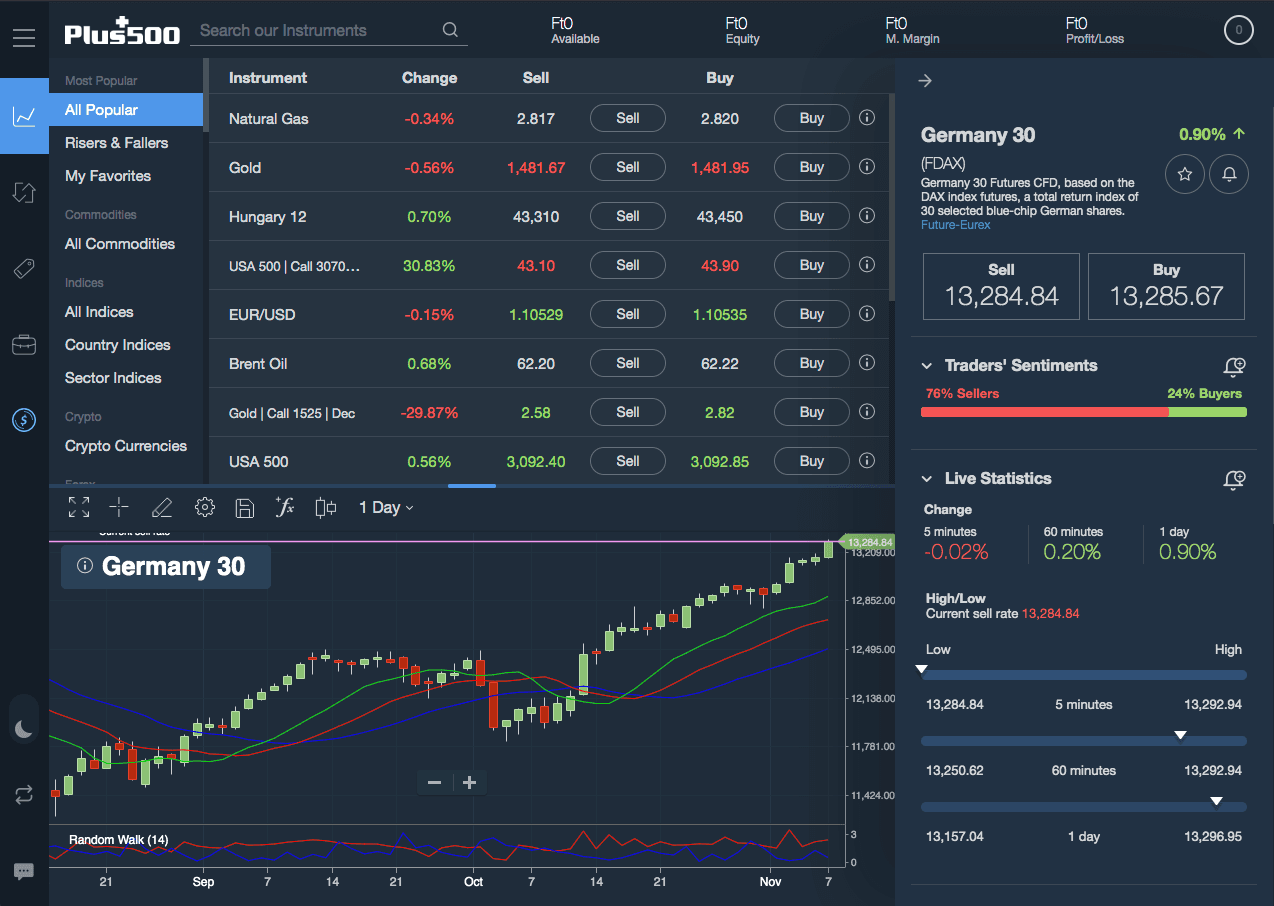

- 2,800+ CFD instruments available

- Proprietary WebTrader platform

- $100 minimum deposit (varies by region)

Founded

2008

Headquarters

Haifa, Israel

Stock Symbol

LON: PLUS

Clients

27 million+ registered

Why choose Plus500

Plus500 is a global fintech powerhouse listed on the London Stock Exchange (LON: PLUS) as part of the FTSE 250 index. Founded in 2008, Plus500 has grown to serve over 27 million registered traders worldwide with its proprietary, user-friendly WebTrader platform. The broker is regulated by 10+ global authorities including FCA (UK), ASIC (Australia), CySEC (Cyprus), MAS (Singapore), and recently obtained licenses in UAE (SCA) and Canada (CIRO) in 2025. Plus500 operates exclusively on a commission-free, spread-based model with free guaranteed stop orders on select instruments. The platform offers 2,800+ CFD instruments across forex, stocks, indices, commodities, cryptocurrencies, ETFs, and options. While the broker excels in simplicity and regulatory compliance, it does not support MT4/MT5 or automated trading, making it best suited for beginners and intermediate traders seeking a straightforward trading experience.

Pros

- FTSE 250 listed - maximum transparency

- Regulated by 10+ global authorities

- User-friendly platform for beginners

- Free guaranteed stop orders

- No trading commissions

- Strong financial stability ($792M revenue 2025)

Cons

- $10/month inactivity fee after 3 months

- No MT4/MT5 or third-party platforms

- Limited research and analysis tools

- No automated trading support