Trust Score: 4.5/100

Based on regulatory status, company history, and financial transparency

- FCA & ASIC Regulated

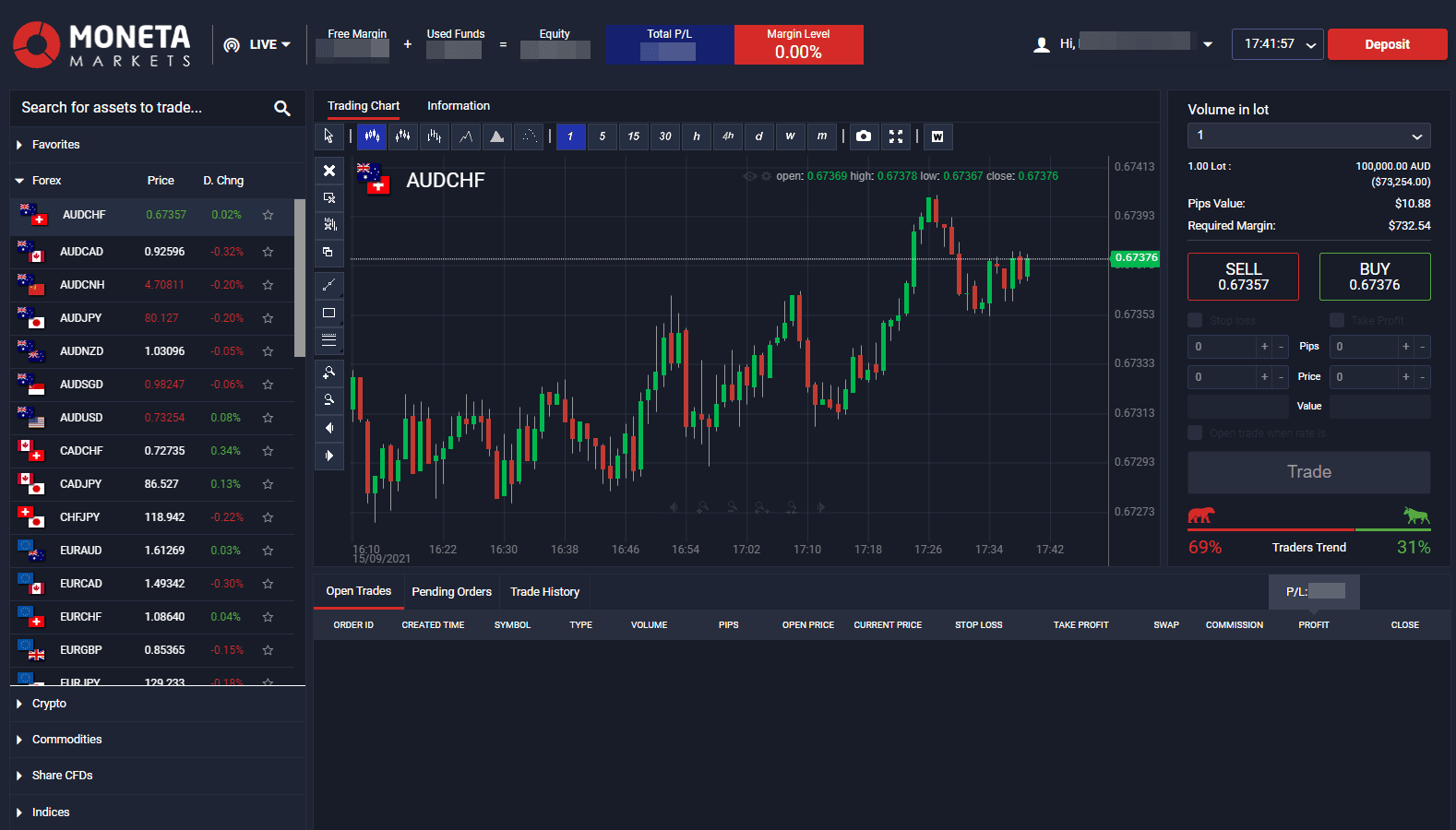

- AppTrader Platform 2026

- Ultra-Fast ECN

- Daily Trade Ideas

Founded

2019

Headquarters

Melbourne, Australia

Why choose Moneta Markets

Moneta Markets accelerates its growth in 2026 with the enhanced AppTrader platform. Offering ultra-fast ECN execution and Tier-1 regulation, it's a top contender for modern traders.

Pros

- New FCA license adds trust

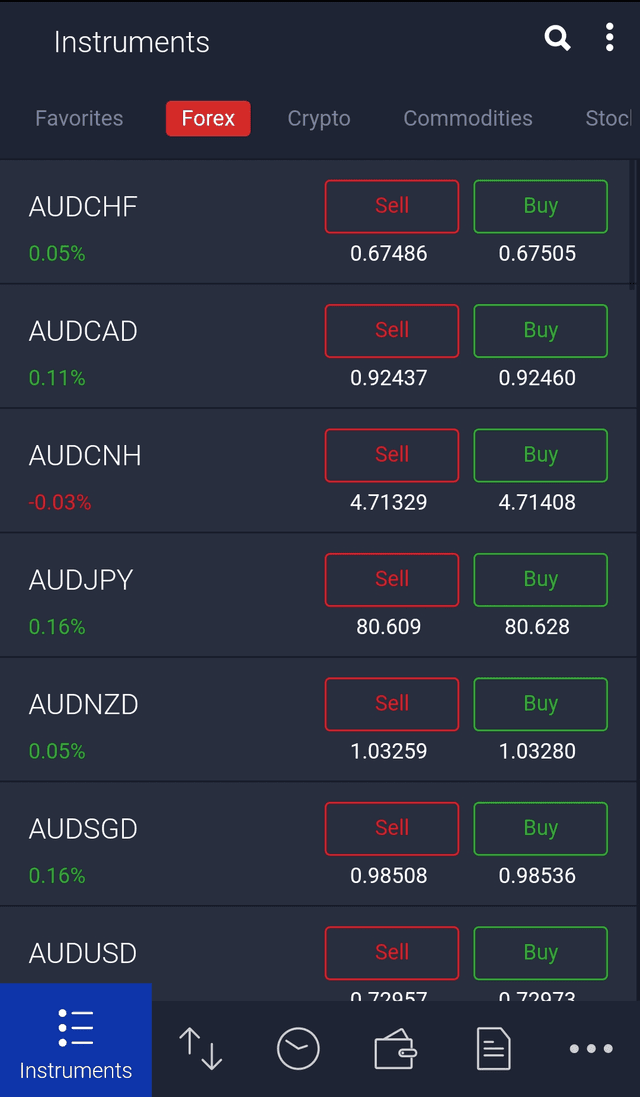

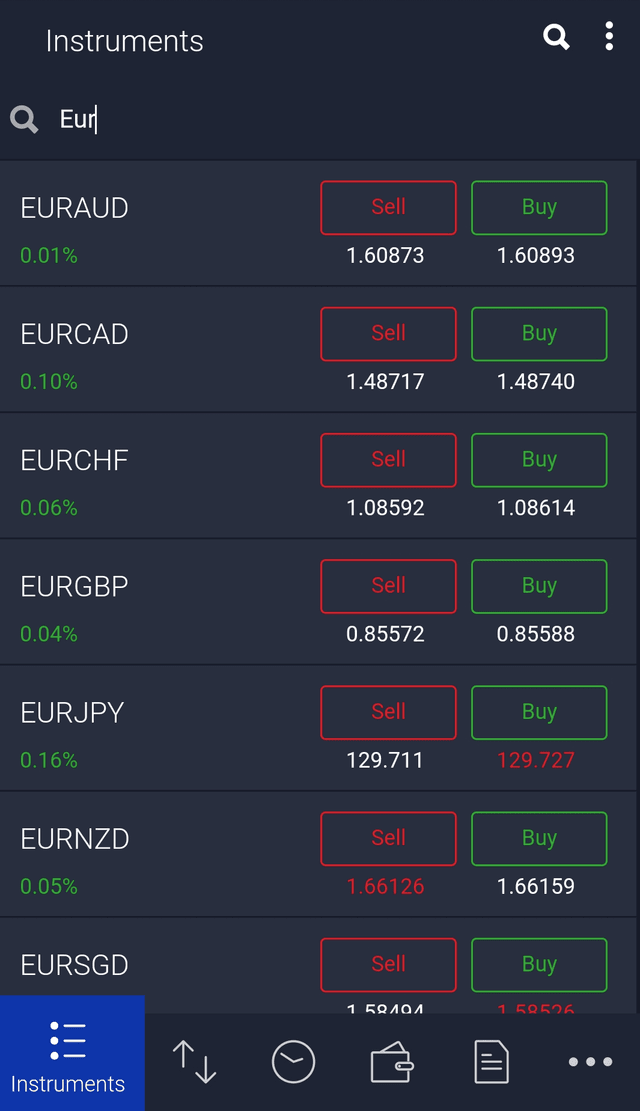

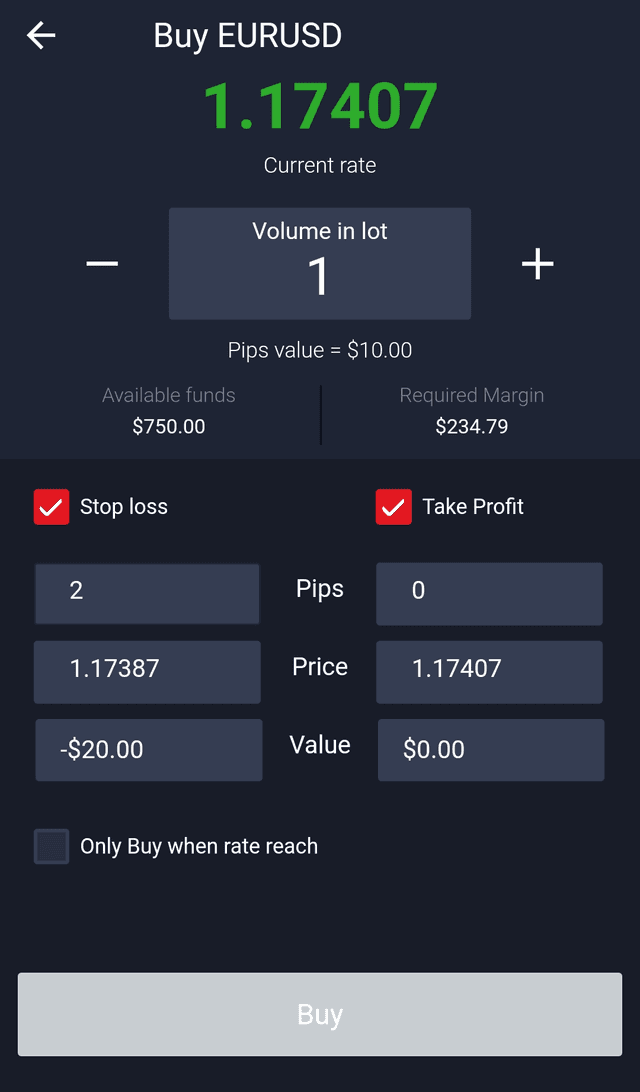

- Excellent mobile app

- Low commissions on ECN

Cons

- Newer brand

- Offshore entity for high leverage

Moneta Markets

Save Wishlist's

Popular choice

Min Deposit: | $50 |

Inactivity Fee: | No |

Regulated: | Yes |