Trust Score: 93/100

Based on regulatory status, company history, and financial transparency

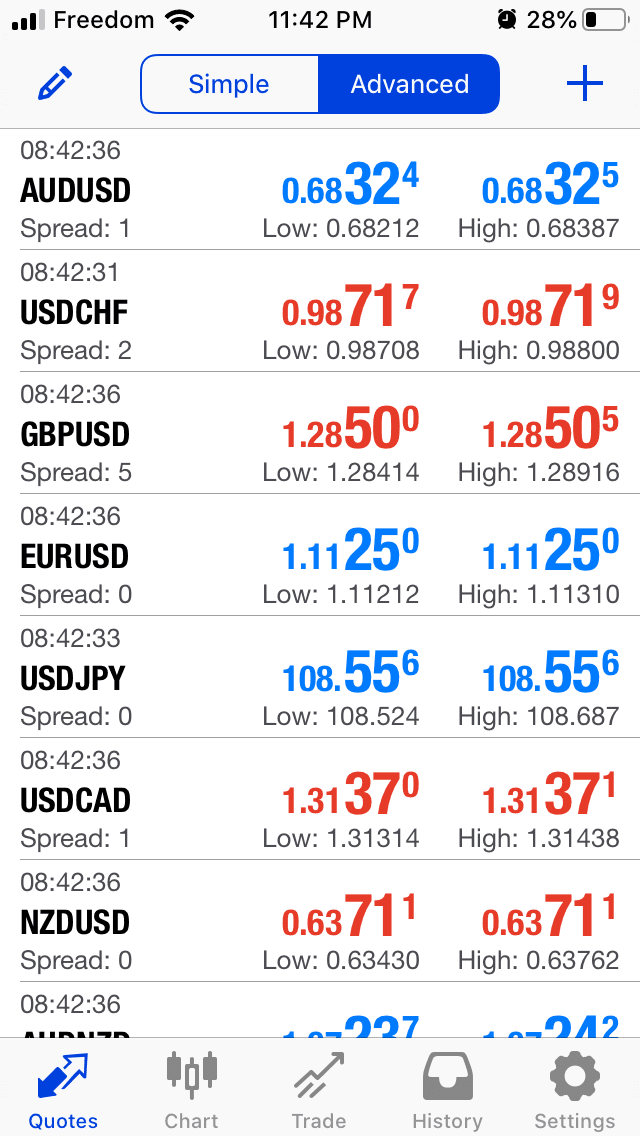

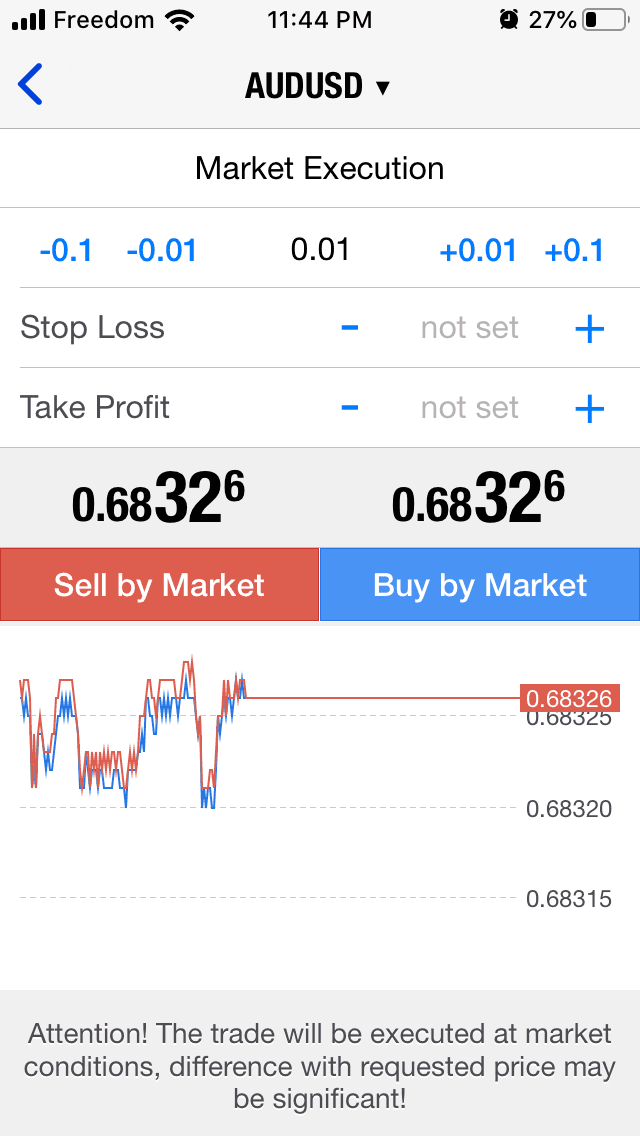

- True ECN Raw Spreads from 0.0 pips

- Regulated by ASIC, CySEC (Tier-1) and FSA Seychelles

- $29 billion+ daily trading volume

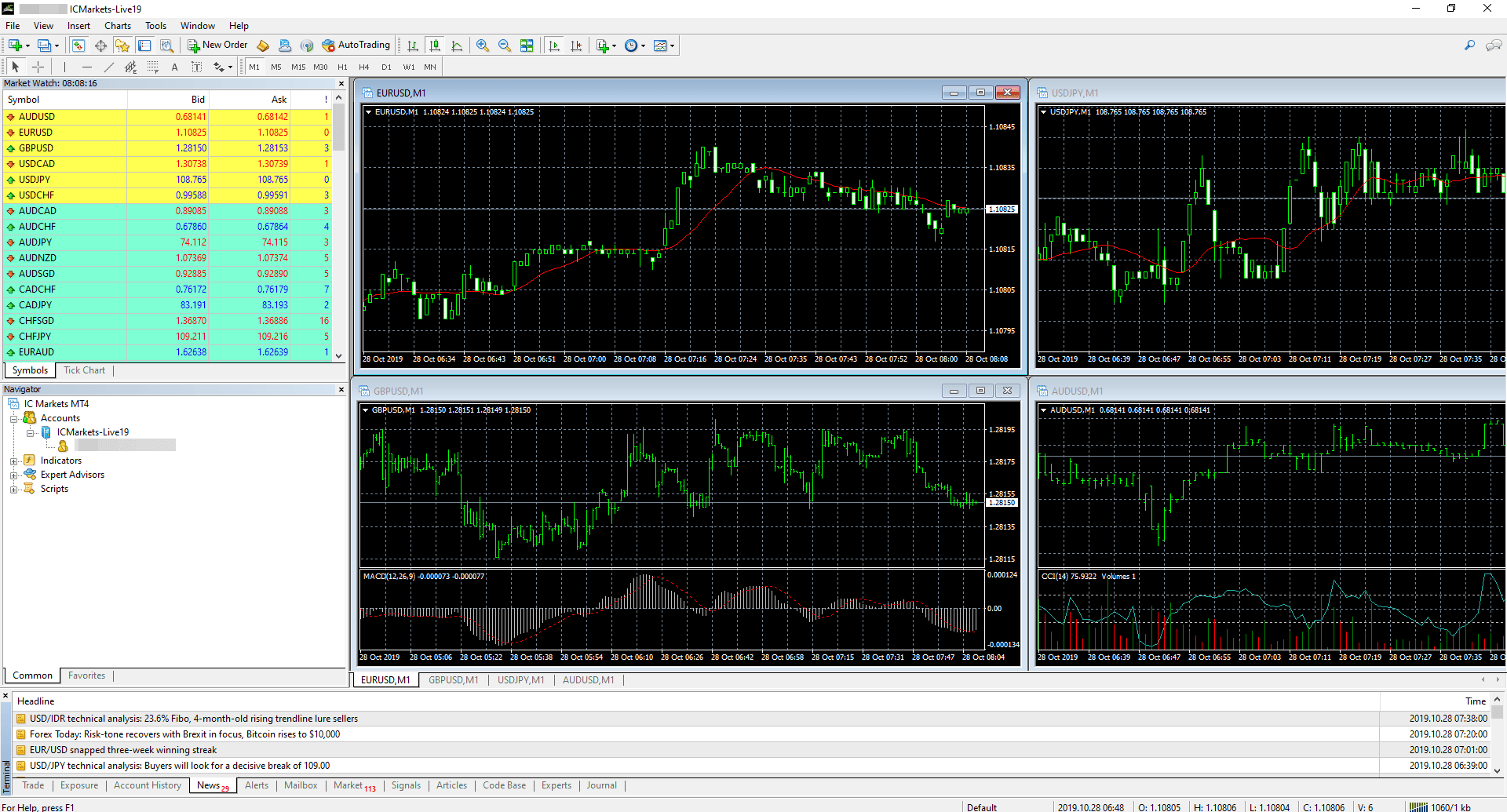

- Equinix NY4/LD5 low-latency execution

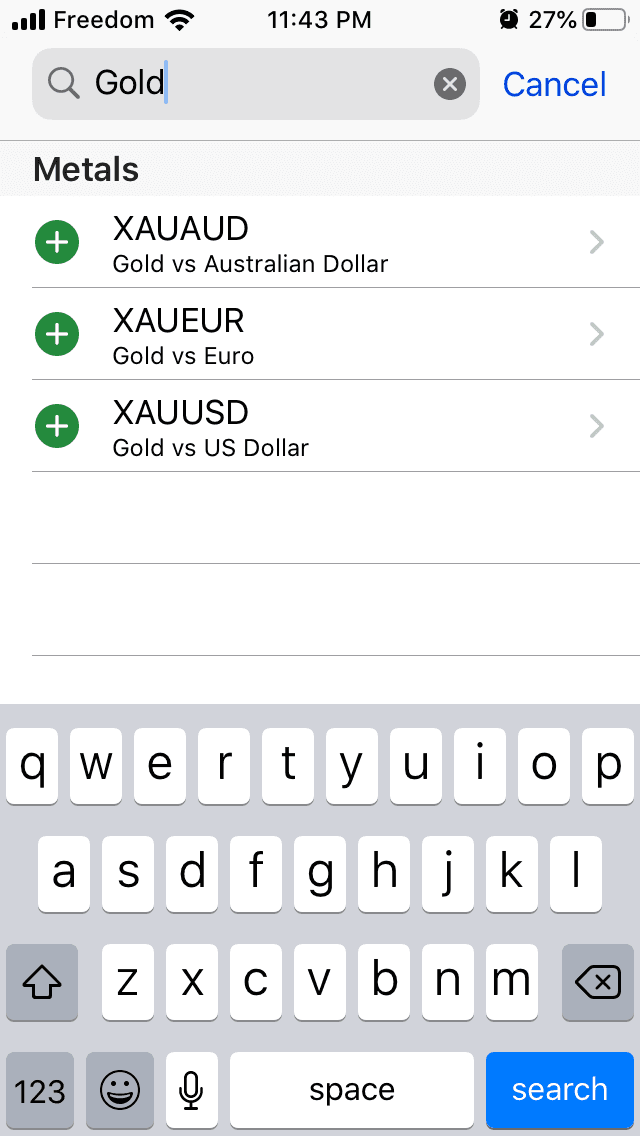

- MT4, MT5, cTrader, TradingView platforms

- 25+ tier-1 liquidity providers

- No restrictions on scalping/hedging/EAs

- IC Social copy trading platform

Founded

2007

Headquarters

Sydney, Australia

Clients

200,000+

Why choose IC Markets

IC Markets is a leading True ECN forex and CFD broker founded in 2007 in Sydney, Australia. Renowned for its institutional-grade execution, ultra-tight raw spreads from 0.0 pips, and deep liquidity from 25+ providers, IC Markets processes over $29 billion in daily trading volume. Regulated by ASIC (Tier-1), CySEC (Tier-1), and FSA Seychelles, the broker offers MT4, MT5, cTrader, and TradingView platforms with no restrictions on scalping, hedging, or automated trading. With Equinix data centers in NY4 and LD5 for low-latency execution, IC Markets is the preferred choice for algorithmic traders and high-volume scalpers. The broker offers copy trading via IC Social, Myfxbook, ZuluTrade, and MetaTrader Signals.

Pros

- ASIC and CySEC Tier-1 regulation

- Ultra-tight raw spreads from 0.0 pips

- Excellent for scalping and EAs

- Low latency execution (Equinix)

- 2,250+ tradable instruments

- No inactivity fees

- 24/7 customer support

Cons

- $200 minimum deposit

- Limited educational resources

- Research tools could be expanded

- No FSCS protection

IC Markets

Save Wishlist's

Popular choice

Min Deposit: | $200 |

Inactivity Fee: | No |

Regulated: | Yes |