Trust Score: 92/100

Based on regulatory status, company history, and financial transparency

- Active Trader Rebates (Cash back)

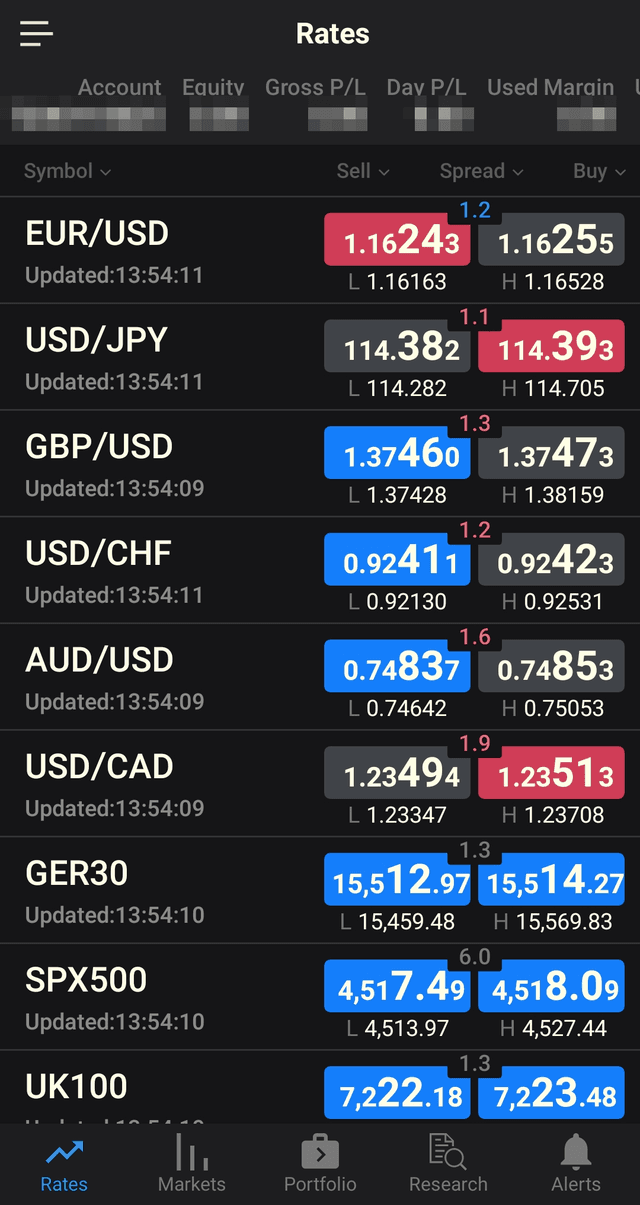

- Spreads from 0.2 pips (EUR/USD)

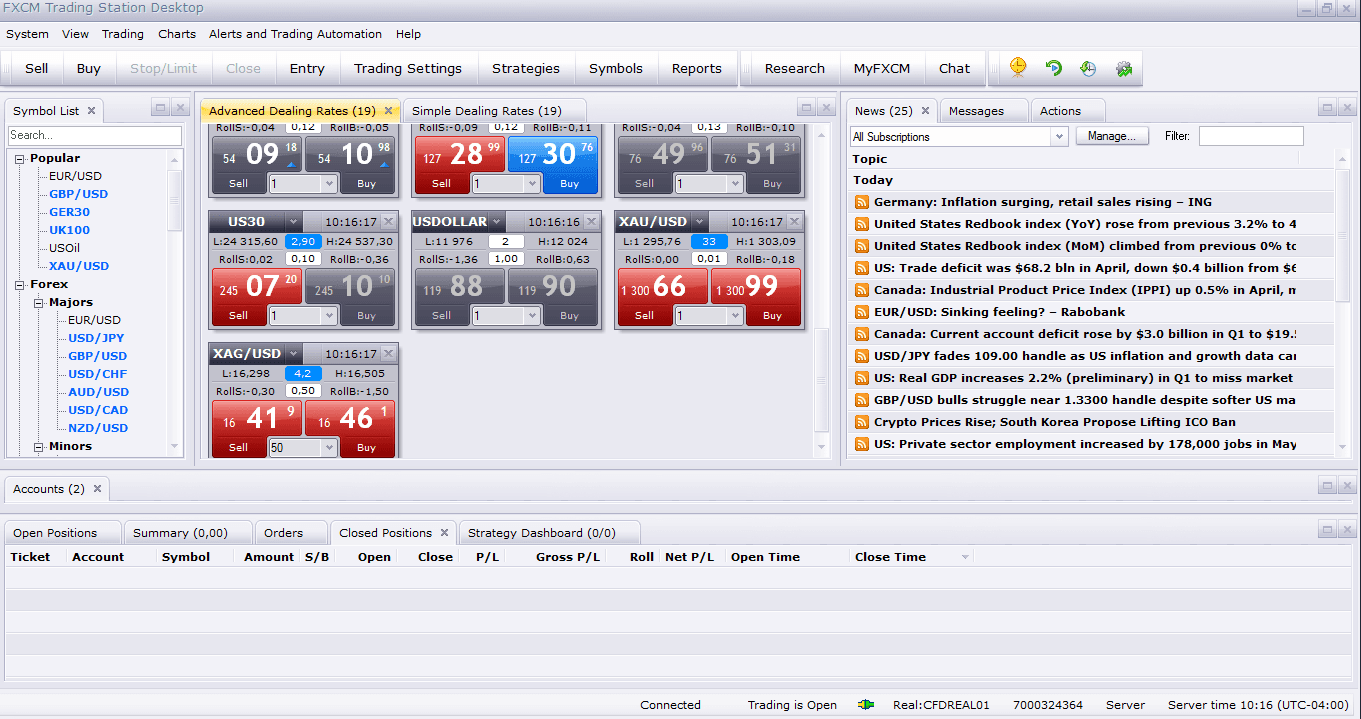

- Proprietary 'Trading Station' platform

- Deep liquidity & API support

- Publicly trusted brand (Jefferies/Leucadia)

Founded

1999

Headquarters

London, UK

Clients

100,000+

Why choose FXCM

FXCM continues to serve active traders in 2026 with its dedicated 'Active Trader' program. Offering rebates up to $8,000 for high volume and spreads as low as 0.2 pips on major pairs, it caters to the serious market participant.

Pros

- Highly regulated (FCA, ASIC)

- Excellent proprietary platform

- Great educational resources

Cons

- Smaller product range than some competitors

- Inactivity fees apply