Trust Score: 90/100

Based on regulatory status, company history, and financial transparency

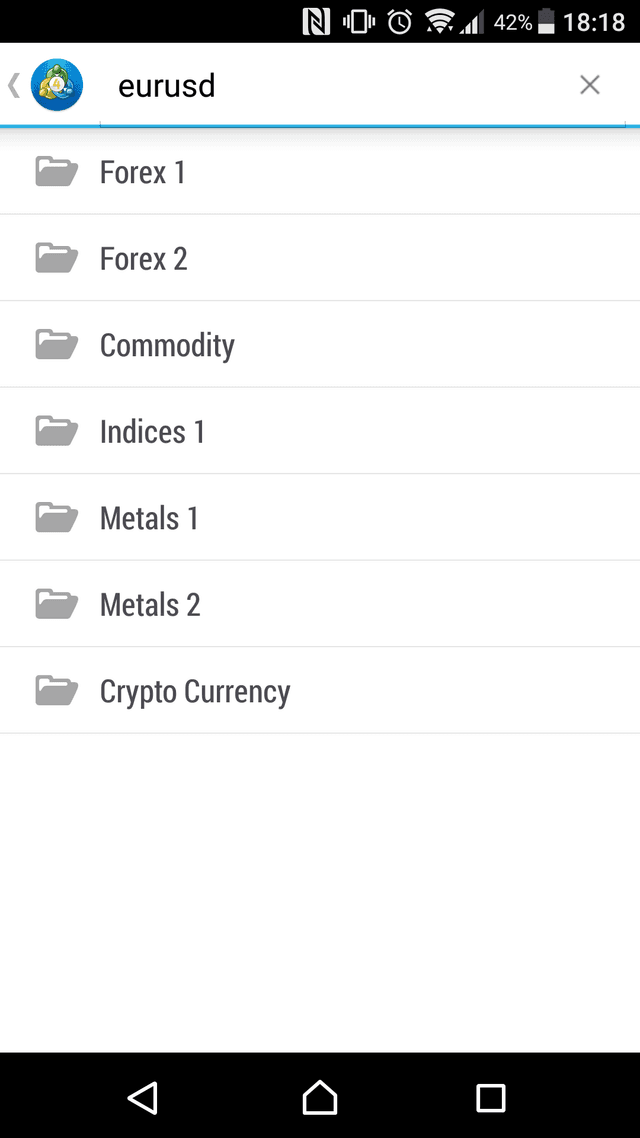

- 10,000+ tradable CFD instruments

- Regulated by ASIC, CySEC, FSCA, FSC, CMA (multi-jurisdictional)

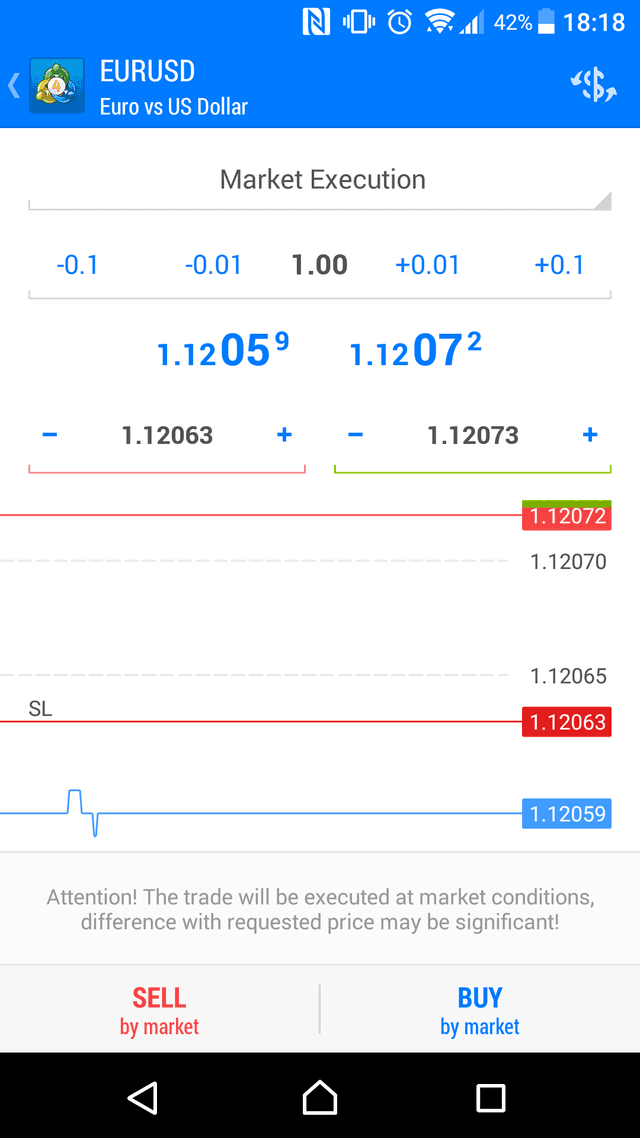

- Raw ECN spreads from 0.0 pips ($6 RT commission)

- 40+ industry awards for excellence

- Iress platform for DMA share trading

- TradingView integration available

- 24/7 multilingual customer support

- FP Markets Academy education

Founded

2005

Headquarters

Sydney, Australia

Clients

200,000+

Why choose FP Markets

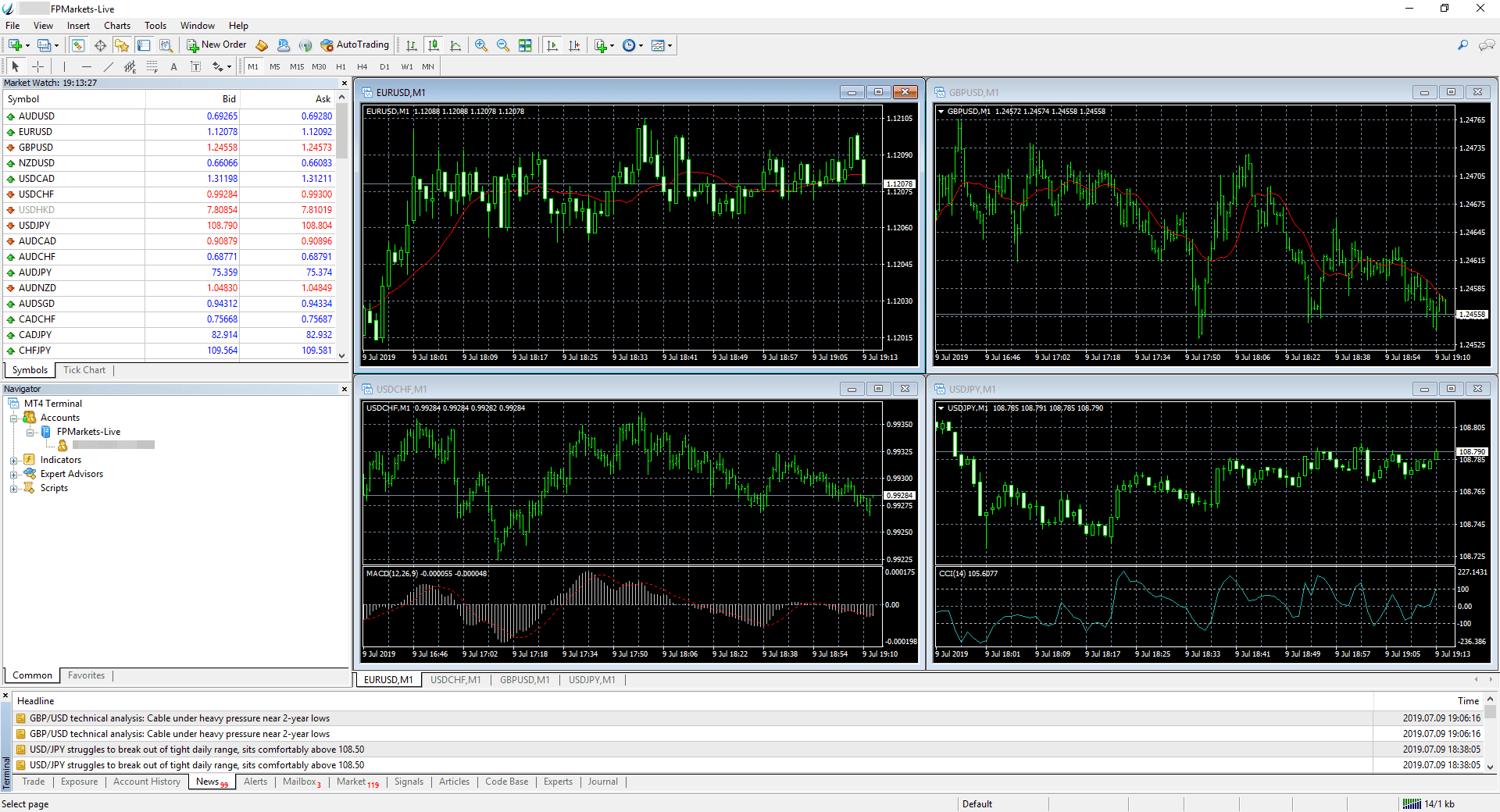

FP Markets is a trusted Australian forex and CFD broker established in 2005, celebrating 20 years of excellence. Regulated by Tier-1 authorities ASIC and CySEC, the broker offers access to over 10,000 instruments with competitive ECN pricing and institutional-grade execution. FP Markets has won over 40 industry awards for its trading conditions, customer service, and platform variety. The broker offers MT4, MT5, cTrader, TradingView integration, and the advanced Iress platform for DMA share trading. With raw spreads from 0.0 pips on ECN accounts, $100 minimum deposit, and 24/7 multilingual support, FP Markets serves traders globally through entities in Australia, Cyprus, South Africa, and Mauritius. The FP Markets Academy provides comprehensive educational resources.

Pros

- ASIC and CySEC Tier-1 regulation

- Raw spreads from 0.0 pips

- 10,000+ instruments available

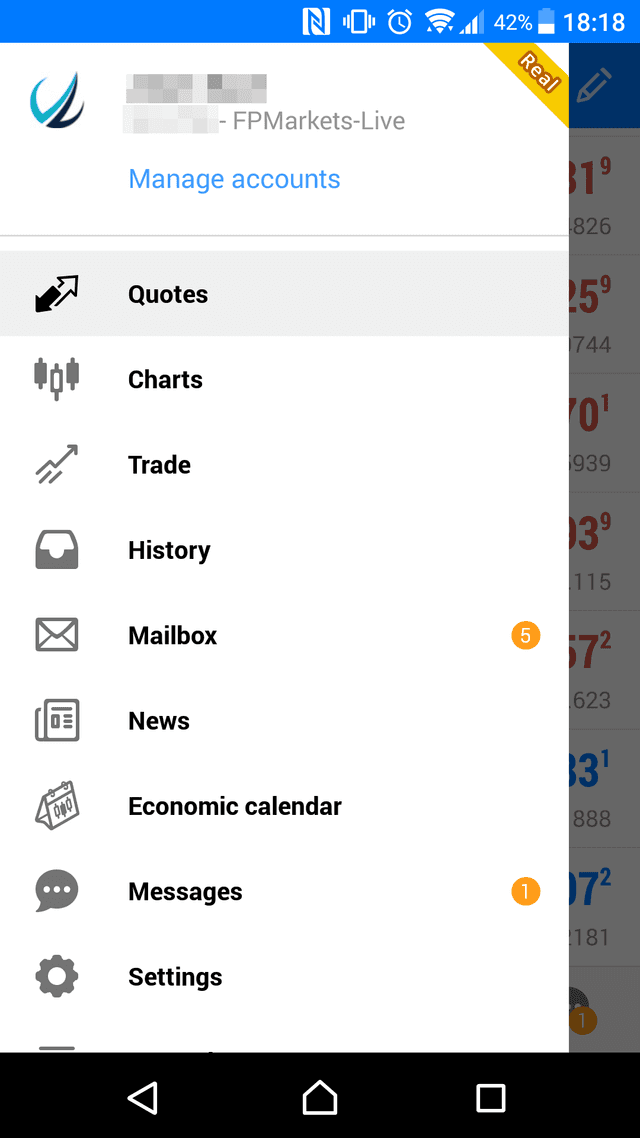

- Excellent platform variety (MT4/MT5/cTrader/Iress/TradingView)

- 40+ industry awards

- 24/7 multilingual support

- $100 minimum deposit

Cons

- Iress platform requires $1,000 minimum

- Limited cryptocurrency selection

- Demo account expires after 30 days

- Iress monthly fee (waivable)

FP Markets

Save Wishlist's

Popular choice

Min Deposit: | $100 |

Inactivity Fee: | No |

Regulated: | Yes |